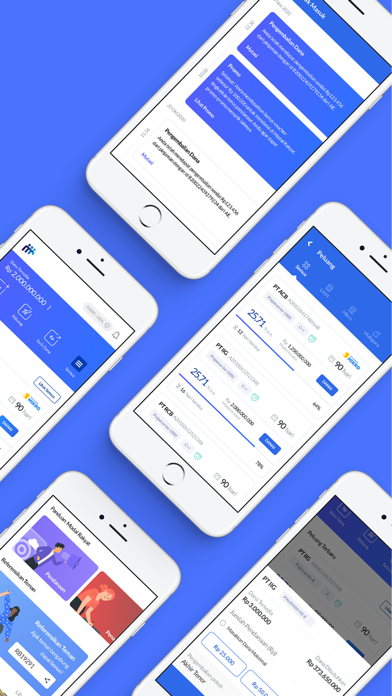

Modal Rakyat

As a P2P lending platform, Modal Rakyat connects lenders with thousands of micro, small and medium businesses from across Indonesia. We ensure a robust analysis, verification, and protection through various methods for your safety blanket.

On Modal Rakyat, lending starts from Rp 5,000,000 per loan. That means everyone can be a lender, including you. And it’s very easy to create a diversified loan portfolio to protect your funds and earn more stable returns. Get started right away and hand pick loans based on your own criteria.

Using Modal Rakyat app, lenders can choose from a wide range of selected loans, including but not limited to:

SME Loans

Micro Loans

Multipurpose Loans

Why Modal Rakyat?

Licensed by OJK

Licensed and monitored by Financial Services Authority of Indonesia or OJK (KEP-27/D.05/2021) & Kominfo.

Attractive Returns

Earn up to 18% p.a

Start From Small Amounts

Just with IDR 5,000,000, you can fund SMEs that went through a strict process of selection from Modal Rakyat’s Team.

Liquid Funding Schemes

Modal Rakyat offers a wide range of loan tenure selections, enabling you to manage your fundings seamlessly.

General Product Information:

Loan Duration: 3 - 12 months

APR: 10% - 18% p.a

Minimum Funding Amount: IDR 5,000,000

Maximum Funding Amount: IDR 2,000,000,000 per loan

Additional Fees: Loan Insurance (If any)

Loan Simulation:

Funding Amount of IDR 10,000,000 with 15% p.a. Interest rate and 3 months tenure would offer you return as follows:

+ Interest = (Interest Rate / Tenure) x Plafond

+ Return = Loan Amount + Interest

+ Interest = (15%/0,25 tahun) x IDR 10,000,000 = IDR 375,000

+ Return = IDR 10,000,000 + IDR 375,000 = IDR 10,375,000

For more information, please contact us:

Phone : (021) 5091-4792

E-mail : [email protected]

Facebook : Modal Rakyat

Instagram : @modalrakyatid

LinkedIn : Modal Rakyat

URL : www.modalrakyat.id